Bucket strategy calculator

Total what you need in each bucket and why it belongs there. I also review our annual spending from the prior year see Step 5 below.

Scrumban Planning Buckets Agile Project Management Agile Software Development Agile Development

How do you create a bucket strategy for retirement.

. But for simplicity the Retirement Budget Calculator displays a four bucket strategy. To determine the amount of money needed in each Bucket I look only at the gap remaining between estimated spending and income. The retirement bucket strategy doesnt advise selling some of the long-term to reduce your risk and capture some of those gains.

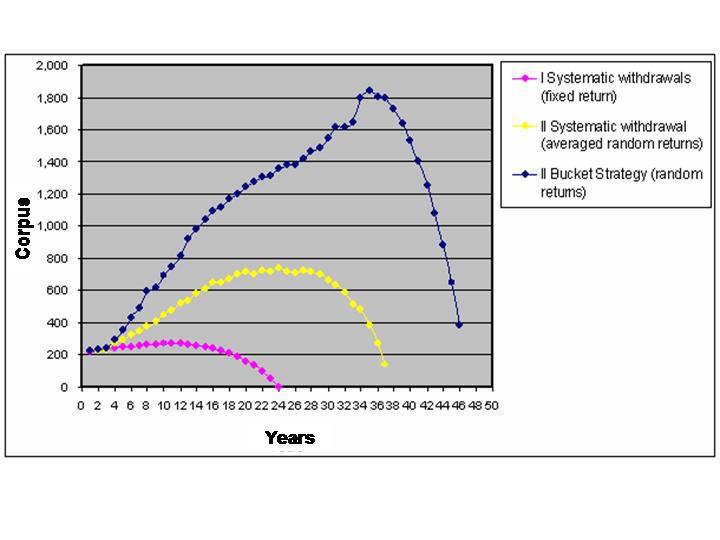

This is money that you need in the short term usually one to four years. How The Bucket Strategy Has Performed in. Its time financial planners and academic types stop jawboning about this rule of thumb and start researching and debating the merits of using the bucket approach to creating.

The bucket strategy provides an opportunity to capitalize on longer-term market growth throughout retirement while securing financial stability for the immediate future. For example lets assume youre planning on spending 100k and expect 20k in SS and a 30k pension. May 2019 Estimate of monthly expenses Annual expenses that would persist in retirement Total average monthly expenses Rent Pension from EPS Superannuation Annuity Other annuity.

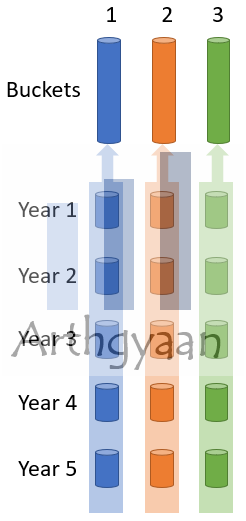

Net Worth excluding cars house etc I calculate the Safe Withdrawal Rates using 3 35 and 4 rates. Finally a long-term bucket will hold equities and riskier investments that you plan to hold for at least 10 years. This strategy also puts both spouses on the same page when it comes to money spending and investing.

These are the four buckets. Aggressive Model Bucket Strategy Calculator for Early Retirement. Provide inputs for overall situation age FF target expenses inflation and return expectations etc.

In its simplest incarnation we use just two bucketsCash and Investments. The Bucket Strategy Series. The answer is a combination of two retirement money management frameworksthe Bucket Strategy and the 4 Rule.

Look up the expenses for the. This approach can increase returns while easing the fear of risk and the tendency to overreact to market fluctuations. How To Build A Retirement Paycheck How I set up the bucket system before retirement How To Manage The Bucket Strategy this post.

Forget the 4 rule. Bucket Strategy Calculator for Early Retirement 2021 version Download. Or bring up a spreadsheet on your computer.

Imagine a retiree with an annual spending of 50000 per year. The bucket strategy sets aside assets for the short term. The Gap would be 50k 100k 20k 30k 50k and Bucket 1 would be 150k 50k x 3.

Income also called cash. For this reason its best to layer a rebalancing strategy on top of the bucket strategy. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

This version of the calculator can also take inputs for multiple currencies. Comment from author Formula. Alternatives to the Retirement Bucket Strategy.

Bucket Strategy Calculator - Early Retirement Scenario -Aggressive Model ver 36. Provide inputs for overall situation till row 16 in Retirement_Inputs sheet age FF target expenses inflation and return expectations etc. Sit down with a paper pen and calculator.

Provide inputs for goals for children. If you need help or have questions visit with an advisor. The Bucket Strategy helps us divide our retirement money between short-term spending needs and long-term investment needs.

In theory the bucket system enables retirees to use their cash cushion to meet short-term spending needs all while riding out market volatility and avoiding withdrawals during a downturn. This person receives 35000 from Social Security and other. Build Your Future With a Firm that has 85 Years of Investment Experience.

There are a number of other ways to organize your finances for retirement.

Understanding The Barefoot Investor Bank Account System Slow Fortune Get Rich Slowly Barefoot Investor Budgeting Finances Budgeting

How Personal Capital Money Management Financial Planning Works Personal Finance Printables Personal Finance Finance

The Bucket Strategy Step By Step Guide Retire Ready Solutions

Using Excel To Plan For Retirement With The Bucket Accounts Method Part 4 Youtube

The Bucket Strategy Step By Step Guide Retire Ready Solutions

How To Plan For Retirement Using The Bucket Approach Arthgyaan

Daily Expense Budget Template Inspired By Barefoot Investor Etsy Australia Barefoot Investor Budget Template Budgeting

Roth Strategy After The Secure Act Calculate Your Benefit Roth Calculator Acting

Personal Finance 301 The Retirement Bucket System Synchrony Bank

How To Take Risks And Embrace Change Fab Working Mom Life Working Mom Life Embrace Change Take Risks

Personal Expenses Calculator Office Templates Cash Flow Statement Statement Template

The Retirement Bucket Strategy Simulator

Buckets Of Money An Investment Strategy For Retirement Planning Retirement Budget Calculator

Amazon Sales Rank Calculator Ebook Writing Amazon Sales Rank Book Marketing

How To Manage Risk When Investing Investing Value Investing Investing Strategy

Food Truck Profit Margin Percentage Calculator Plan Projections Starting A Food Truck Food Truck Business Food Cost

Retirement Bucket Strategy Calculator Youtube