Mutual fund expense ratio calculator

Pay 0 for 75 days of Genius On Indias 75 years of Independence by signing up within 75 hours. We can call it the maintenance fee of the investment.

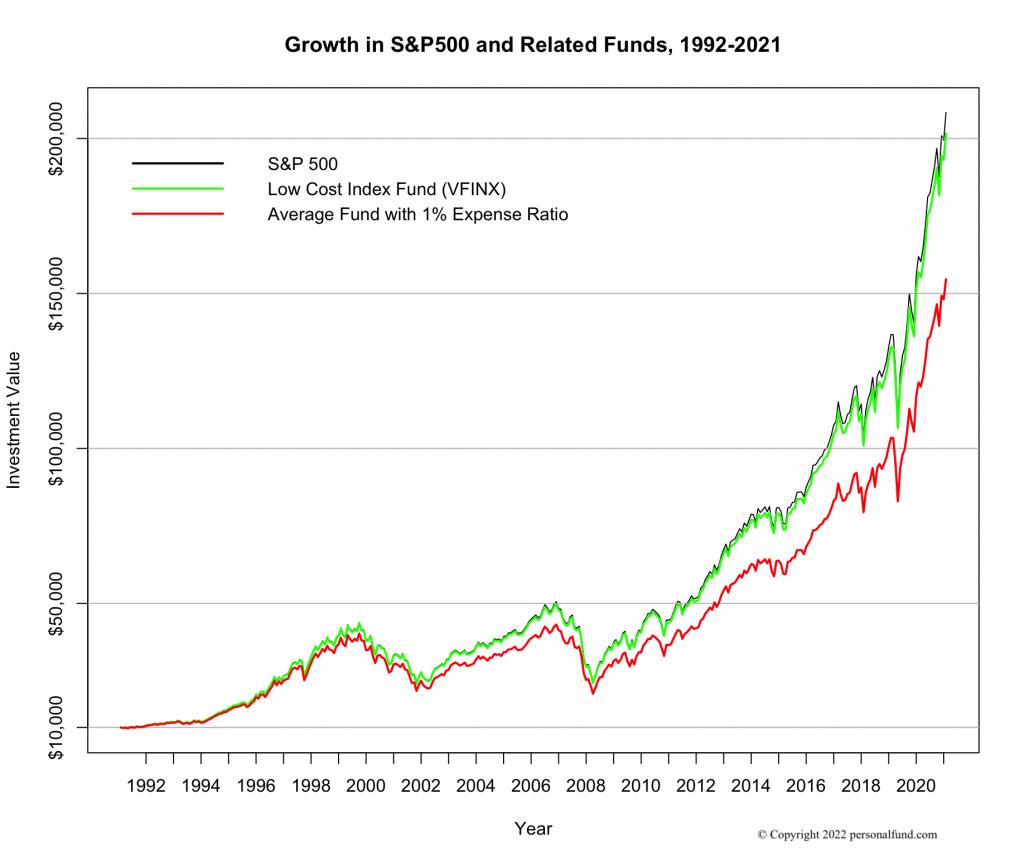

Mutual Fund Expense Ratio Personal Fund

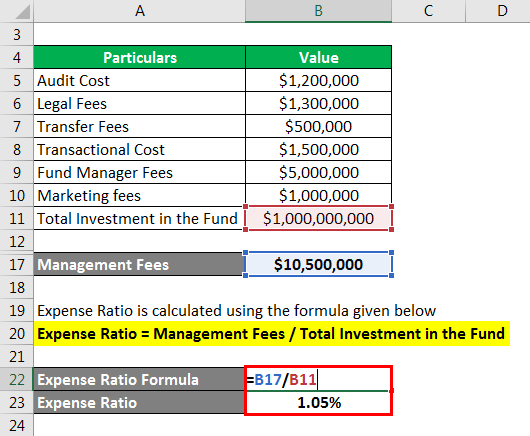

For example if it costs 1 million to run a fund in a given year and that fund held 100 million in assets its expense ratio would be 1.

. A Systematic Withdrawal Plan allows you to withdraw a pre-defined amount at fixed. 1020 and the repurchase price will be Rs. Click to explore our complete range of equity mutual funds.

Expense ratio is one of them. SWP allows you to withdraw a certain amount of money at regular intervals from your mutual fund schemes. Total Expense Ratio TER of Mutual Fund Schemes Contact Us.

Childrens Career Fund Calculator Retirement Benefit Pension Fund Calculator Products Equity Funds Debt Funds Liquid Funds Hybrid Funds. If the applicable NAV is Rs. 1000 salesentry load is 2 per cent and the exitrepurchase load is 2 percent then the sales price will be Rs.

A high expense ratio and high entryexit loads charged by the fund house lowers your final value of the overall capital gains. Expense Ratio of more than 15 is considered to be very high from an investors point of view. Standard Deviation Calculator Income Tax Calculator Age Calculator Time Calculator BMI Calculator GPA Calculator Statistics Calculator Fraction Calculator Diabetes.

What is a good expense ratio for a mutual fund. Invest in large cap small cap mid cap and many more equity funds by ICICI Prudential MF. Finally add the annual fees known as the mutual funds expense ratio.

Download UTI MF Mobile App. Mutual Fund and ETF Expense Ratio. A fund that charges 30 basis points charges 30 or 0003 of the amount you have invested per year.

Lower fees mean more of your cash will. Mutual Fund and ETF Turnover Ratio. For investments above Rs10000 the advisor can charge Rs150 for the first time and Rs100 for subsequent investments.

Anyone can invest in mutual funds. A funds expense ratio is listed as a percentage and represents the percent of your investment that you are charged for investing in the fund. Mutual fund comparison tool will help you compare multiple mutual funds on performance expense ration AUM returns risks portfolio allocation in India.

1000000 100000000 01 1. More Funds from UTI Mutual Fund. Pro Investing by Aditya Birla Sun Life Mutual Fund.

A fund that has an expense ratio of 20 costs the equivalent of 0002 of the amount you have invested. If your investment in this fund is Rs 100000 and assuming your investment value grows to Rs 100500 and 100125 on two subsequent days this is how much expense ratio you pay on each day-. Indiabulls Asset Management Company Limited CIN-- U65991HR2008PLC095063 Corporate Office- 4th Floor Tower 1 One International Centre erstwhile known as Indiabulls Finance Centre Prabhadevi West Mumbai 400 013 T 91 22 6189 1300 F 91 6189 1320.

You can Buy ETF There the expense ratio will also will be low. 05 to 075 Expense Ratio for an actively managed portfolio is considered to be a good one and beneficial for the investors. Star Health 74225 2975.

Lower fees mean more of your cash will stay invested for potential long-term growth. Frequently Asked Questions FAQ. Find the best equity funds for your needs.

Mutual Fund Trade Details. A scheme with lower expense ratio mutual funds is considered cost effective. A fund with an expense ratio of 110 each year costs 0011 of the total assets you have in the fund.

Backed by years of economic research our mutual fund cost calculator reveals each funds true price tag and estimates how hidden expenses will eat away at returns over time so. An Expense Ratio is the fee charged by a fund either a mutual fund or ETF for managing the funds assets. Understand how you can avail a regular cash flow with SWP using our SWP calculator.

This is outside the expense ratio that the fund charges you. The expense ratio is a fee charged by mutual funds and ETF providers for the concept of managing the assets in the fund. ETFs usually have a lower expense ratio than pure mutual funds.

It is the total percentage of the investment used for administrative management advertising and other expenses. Let us understand the expense ratio meaning with an expense ratio example assuming your mutual fund schemes expense ratio is 125. Current Expense Calculator MC 30.

It usually ranges between 01 to 1 but it can go as low as 0045 like in the SPY case and up to 295 like in the case of Global X SuperDividend Alternatives ETF.

Planner Inserts Debt Payoff Credit Card Interest How To Calculate Credit Card Interest Creditcard Budgeting Money Debt Payoff Credit Card Debt Payoff

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula And Fund Calculation Example

Total Expense Ratio Formula Ter Calculator Excel Template

Pin En Investment

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula Calculator Example With Excel Template

Is Investing In Real Estate For You Hipster Investments Investing Real Estate Investing Hvac Maintenance

Total Expense Ratio Formula Ter Calculator With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Importance And Use Of Weighted Average Cost Of Capital Wacc Cost Of Capital Financial Strategies Investing Money

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

What Is An Expense Ratio

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula Calculator Example With Excel Template